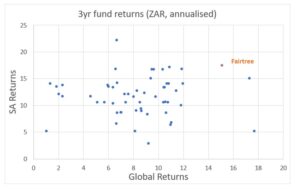

The Fairtree Global Equity Prescient Funds’ exemplary track record is illustrated in the graph above (left) that shows a sample of 57 investment houses with a global equity fund with a track record of 3 years on the X-axis and their ‘best’ SA equity fund over the same period on the Y-axis.

The graph above (right) captures the same global equity / local equity fund inputs (a sample of 41 investment houses with a relevant global equity fund track record) and return outcomes but over a 5-year term. The graph illustrates how few asset managers in South Africa have the depth and skill in both capabilities worthy of attracting both local and global equity flows on a sustained basis.

For more information about the Fairtree Fund Stable including these and other funds please contact Ryan Jamieson ([email protected]) or on +27 82 461 8957.

We are Fairtree

Subscribe to our newsletter

Stay informed with the latest insights and updates. Subscribe to our newsletter for expert analysis, market trends, and investment strategies delivered straight to your inbox.

"*" indicates required fields

FAIRTREE INSIGHTS

You may also be interested in

Explore more commentaries from our thought leaders, offering in-depth analysis, market trends and expert analysis.

Macro Pulse Episode 21

In this episode Jacobus discusses SA equities, SA bonds and the appreciating of the US dollar.

Fairtree Market Insights with Karena Naidu | Episode 8

In this episode, we dive into our Chinese exposure, exploring what’s happening with the major e-commerce players in China. We also take a closer look at the broader emerging markets space, unpacking key trends and where we’re seeing potential growth.

Macro Pulse Episode 20

In this episode, Jacobus discusses major events leading up to year-end, recent US court cases, and the rise in long bond yields.

About you…

By proceeding, I confirm that:

- To the best of my knowledge, and after making all necessary inquiries, I am permitted under the laws of my country of residence to access this site and the information it contains; and

- I have read, understood, and agree to be bound by the Terms and Conditions of Use described below.

- Please beware of fraudulent Whatsapp groups pretending to be affiliated with Fairtree or Fairtree staff members.

If you do not meet these requirements, or are unsure whether you do, please click “Decline” and do not continue.